Should You Sell Your Patek Philippe? Why Patek Watches Hold Value

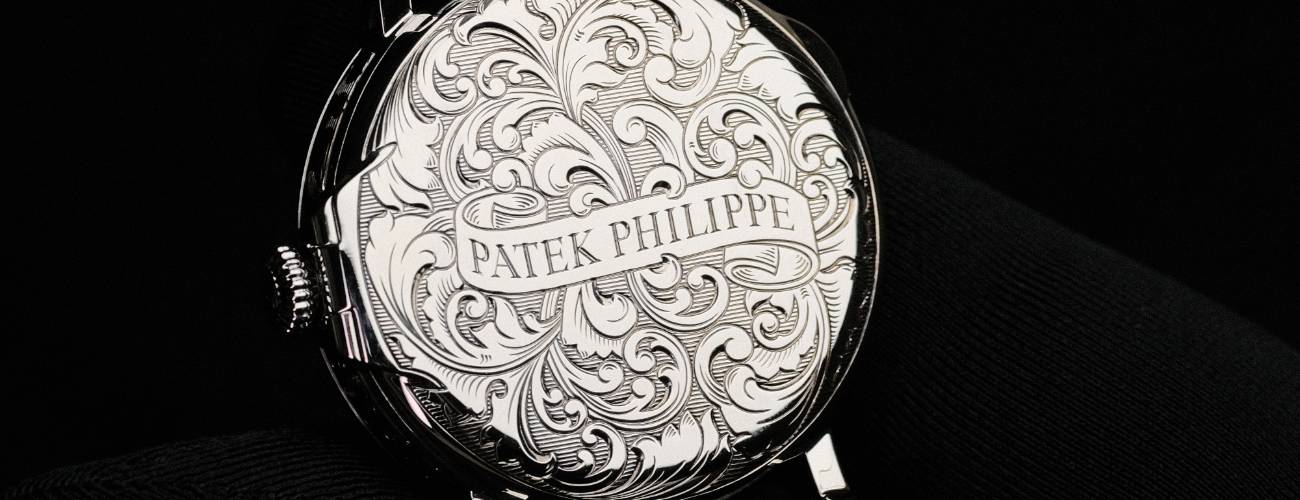

Patek Philippe watches, with their meticulous craftsmanship, timeless designs, and esteemed heritage, have long been considered among the pinnacle of luxury timepieces. For the passionate horologist, ownership of a Patek Philippe is often likened to holding a piece of horological history on one’s wrist. Yet, beyond the artistry and reputation, lies a more pragmatic consideration – how well do these watches hold or even increase in value? In this comprehensive examination, we will endeavour to answer that very question.

Does Patek Philippe Watches Increase In Value Over Time?

Undeniably, many Patek Philippe watches appreciate in value. This appreciation is a result of a combination of brand prestige, limited production numbers, and high demand amongst collectors. Unlike standard consumer goods which lose value once purchased, a Patek can sometimes be an investment, growing in worth over the years. Not every model sees this rise, but many, especially limited editions or those with particular horological significance, have a history of increasing in value.

Should You Sell Your Patek Philippe?

Timing the Sale: Market Trends and Demand

The luxury watch market, much like any market, is subject to trends and fluctuations. Periods of high demand for particular models can drive prices upwards, whilst economic downturns might see a dampening in enthusiasm. Hence, understanding current market conditions, the popularity of your specific model, and the broader economic landscape can help inform a decision to sell.

Evaluating Personal and Investment Factors

Emotionally, selling a Patek Philippe can be challenging. For many, such watches hold personal memories and significance. On the investment side, one should consider the original purchase price, the current market value, and potential future appreciation.

Calculating Return on Investment

Your return on investment (ROI) is calculated by examining the current or potential sale price of the watch in relation to its purchase price and any maintenance costs incurred. An impressive ROI could indicate a prime time to sell, while a lower ROI might suggest waiting.

When Is The Best Time To Sell Your Patek Philippe?

Whilst it’s tempting to look for a definitive answer, the truth lies in a combination of market trends, personal factors, and the specific model in question. Collectors might clamour for a particular piece due to its rarity, historical significance, or even pop culture relevance, driving up its price. Monitoring auction results and staying in tune with the watch community can provide valuable insights.

The Best Patek Philippe Models For Investment

Patek Philippe, with its extensive range of models, offers something for every collector and investor. While all their pieces are a marvel of craftsmanship and elegance, certain models have demonstrated remarkable appreciation over time, making them particularly alluring for the savvy investor.

Nautilus (Ref. 5711)

Introduced in 1976, the Nautilus, particularly the Ref. 5711, is one of Patek Philippe’s most iconic designs. With its unique porthole-shaped case and integrated bracelet, it offers a blend of sporty aesthetics and luxury. Due to its immense popularity and limited production, the demand for the Nautilus has always exceeded its supply, leading to significant appreciation in the secondary market.

Calatrava (Ref. 3919)

The Calatrava epitomises Patek Philippe’s commitment to timeless elegance. The Ref. 3919, with its classic round case, hobnail bezel, and Roman numerals, is a model that has consistently retained its value. Its understated design appeals to both collectors and casual enthusiasts, ensuring a steady demand.

Perpetual Calendar Chronograph (Ref. 2499)

The Ref. 2499, produced between 1951 and 1985, is not only a technical marvel but also a piece of Patek’s illustrious history. Given its limited production run and the combination of a perpetual calendar with a chronograph, it is highly sought after and fetches impressive prices at auctions.

Aquanaut (Ref. 5167A)

Introduced in 1997, the Aquanaut is a relatively younger model but has quickly risen in stature. The Ref. 5167A, with its tropical rubber strap and unique textured dial, has become a favourite among younger enthusiasts, resulting in significant appreciation, especially in recent years.

Minute Repeater (Ref. 5303R)

Minute repeaters are the pinnacle of horological craftsmanship, and Patek Philippe’s Ref. 5303R is no exception. With its openworked case allowing a view of the gongs and hammers, it’s a treat for both the eyes and ears. Given its complexity and the brand’s reputation in creating some of the best repeaters, it holds immense investment potential.

⌚️ Read more: Patek Philippe Watches With The Best Resale Value.

Tips For Investing In Patek Philippe Watches

Investing in watches, especially those from brands as prestigious as Patek Philippe, requires a blend of passion, knowledge, and strategic thinking.

1. Research Before Purchasing

Before making any investment, it’s essential to thoroughly research the specific model you’re considering. Understand its historical significance, production numbers, and its place in the broader Patek Philippe lineup.

2. Build Relationships with Dealers

Establishing a good rapport with watch dealers and boutiques can give you access to limited-edition releases and rare pieces, which often have higher appreciation potential.

3. Diversify Your Collection

While certain models might be the talk of the town today, the watch market can be unpredictable. Diversifying your collection can hedge against potential downturns in demand for specific models.

4. Preserve Originality

It’s crucial to keep the watch as close to its original state as possible. This includes retaining its box, and paperwork, and avoiding any customisations or modifications.

How To Look After Your Patek Philippe Watch

Preserving the intrinsic and monetary value of your Patek Philippe watch requires meticulous care.

Regular Servicing

Just like a luxury car, your Patek Philippe requires regular servicing to maintain its performance. It ensures the movement remains accurate and extends the life of the watch.

Avoid Water Unless Certified

While many Patek Philippe watches have a degree of water resistance, it’s advisable to avoid exposing the watch to water unless it’s specifically designed for such activities, like the Aquanaut.

Protect from Shocks

Avoid wearing your Patek Philippe during activities where it might experience significant shocks or vibrations. This includes sports like golf or tennis.

Store Appropriately

When not being worn, the watch should be stored in a cool, dry place, preferably its original box. For models with an automatic movement, consider a watch winder to keep the movement running.

Handle with Clean Hands

Always ensure your hands are clean when handling the watch to prevent any transfer of oils or dirt onto its delicate parts.

Patek Philippe Watches Hold Their Value Well

In the realm of luxury watches, few brands command the respect and value retention that Patek Philippe does. Their combination of craftsmanship, history, and limited production ensures that many models not only retain value but appreciate over time. Whether as a personal treasure or an investment, a Patek Philippe is undoubtedly a prized possession.

Frequently Asked Questions

How often should I service my Patek Philippe watch?

Patek Philippe watches are a marvel of craftsmanship and precision. To ensure they maintain their optimum performance and longevity, it’s typically recommended to have them serviced every 3-5 years. This interval allows professionals to check, clean, and, if necessary, replace any worn parts, ensuring the movement’s accuracy. However, the specific service period can vary based on the model and usage. It’s always advisable to consult the accompanying manual or an authorised service centre for tailored guidance.

Are all Patek Philippe watches good investments?

While Patek Philippe as a brand is renowned for timepieces that hold or even appreciate in value, it’s essential to note that not all models are guaranteed to see an increase in their worth. Factors like production numbers, historical significance, and market demand can play a significant role. Therefore, if one is considering a Patek Philippe purely from an investment perspective, thorough research, understanding of market trends, and perhaps even consultation with watch experts or seasoned collectors can be invaluable.

Can I wear my Patek Philippe daily?

Patek Philippe watches are designed to be both aesthetically pleasing and functionally robust. With the right care, they can certainly be worn daily. However, it’s essential to be mindful of the environments and activities you expose your watch to. Regular exposure to elements like moisture, extreme temperatures, or potential physical shocks could affect its longevity and value. For daily wear, it’s also advisable to ensure the specific model is suited to your daily activities.

Is it better to buy a new or vintage Patek Philippe for investment?

Both new and vintage Patek Philippe watches hold potential as investments. Vintage models, especially those with a storied provenance, rarity, or unique features, often command higher prices at auctions due to their limited availability and historical significance. On the other hand, certain new models, especially limited editions, can also be appreciated significantly. The key is understanding the market, the particular appeal of a model, and making informed decisions based on research and expert opinions.

⌚️ Read more: New Vs. Old Watches – What’s The Better Investment?

Why are Patek Philippe watches so expensive?

Patek Philippe’s reputation for producing some of the world’s finest watches is built on a foundation of unparalleled craftsmanship, meticulous attention to detail, and a rich history spanning over 180 years. The materials used are of the highest quality, and many of their timepieces involve hundreds of hours of handwork by skilled artisans. Furthermore, the brand’s commitment to producing limited quantities and adhering to the strictest quality standards ensures that each piece is a masterpiece, justifying its premium price.

How can I verify the authenticity of a Patek Philippe?

Authenticating a luxury timepiece like a Patek Philippe is a meticulous process. Firstly, consult reputable watch dealers or experts. Patek Philippe also offers an archival service, providing extracts from their archives that can verify the production date and sale of the watch. Physical examination, checking serial numbers, movement, craftsmanship, and accompanying documentation can all offer clues. However, due to the sophistication of counterfeits, expert consultation is always recommended.

Can Patek Philippe watches be insured?

Given the significant monetary and sentimental value associated with Patek Philippe watches, insuring them is a wise decision. Many insurance companies offer specialised policies for luxury timepieces or valuable personal items. These policies can cover potential losses from theft, damage, or even accidental loss. When insuring, ensure you have a recent valuation and keep all documentation, including purchase receipts and service records, to simplify any potential claims process.